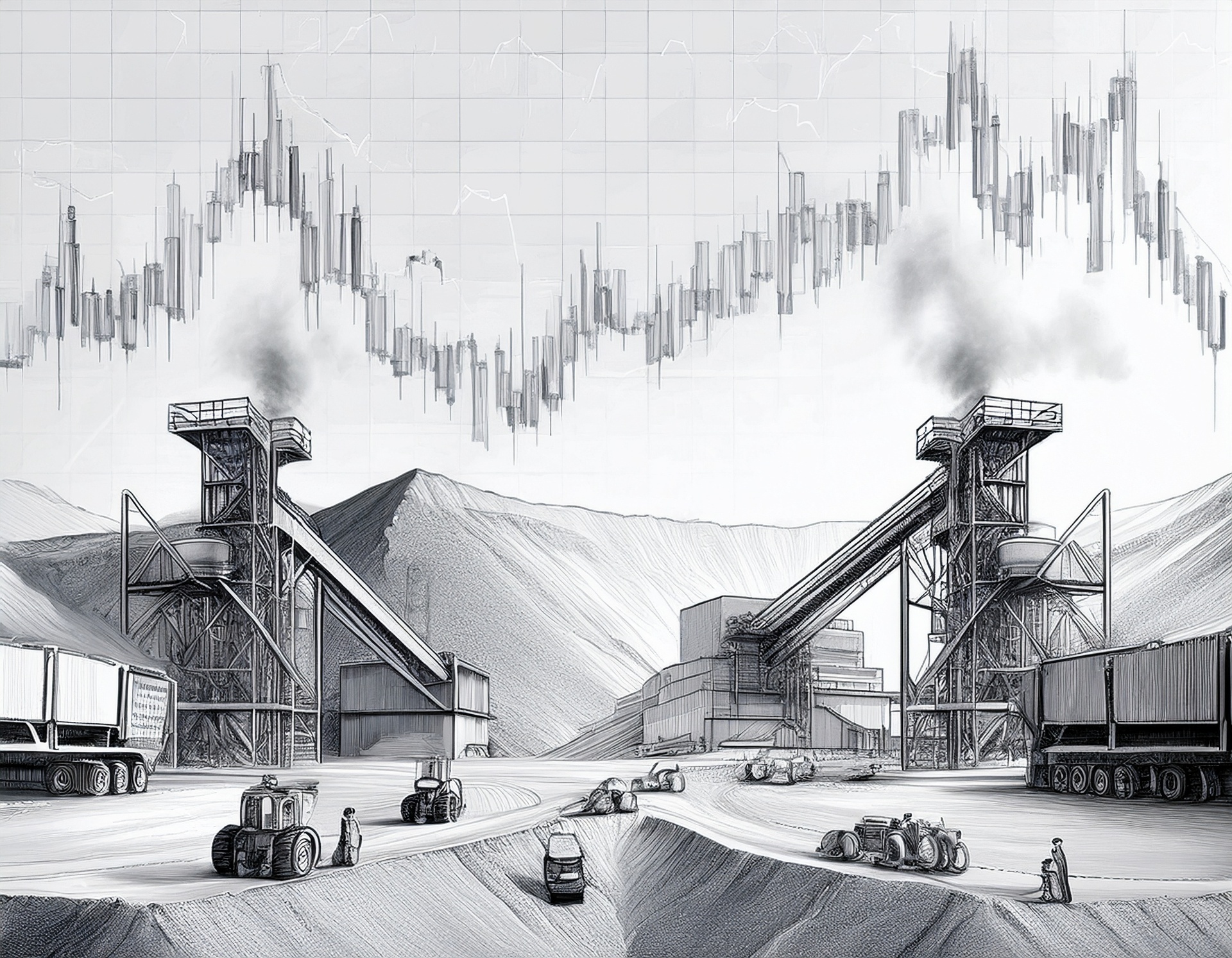

The Real Asset Chartbook

Data Driven Analysis of the Economies Industrial Core

Sign up for the Weekly Real Asset Chartbook

As investors, we face the same problem every day: how do we allocate capital to earn a good risk-adjusted return? Despite the regularity with which we must answer the question, every time we sit down to answer it, we must do so in a completely different political-economic context. This is true regardless of investment style or focus. While not an insurmountable challenge, maintaining an understanding of the context in which you are allocating capital (situational awareness) and having an informed opinion about whether and how the ongoing context change impacts the long-term value of the assets can be taxing from both a time and cost perspective. This document aims to reduce the opportunity and very real information costs of maintaining situational awareness within the liquid real asset universe. We at Massif Capital expect the contextual understanding of the investment environment gained from the weekly review of this document to add value to your investment practice in several ways:

1) Potential risks to the investment thesis can be better anticipated, allowing proactive evaluation of potential portfolio impact and a great ability to fill information gaps associated with known unknowns.

2) Better grasp of the current investment context creates a more nuanced understanding of knowledge boundaries.

3) Situational awareness facilitates the maintenance of investors’ behavioral edge through quicker and surer adaptation to the dynamic investment environment.

With those goals in mind, this document needs to be understood within the philosophical context with which Massif Capital understands the world, as it differs from that of many. First and foremost, we understand the modern global economy as having a digital veneer but an industrial core. While the world may appear to be dominated by technology, consumer goods, and services in terms of market capitalization and media attention, its foundation remains firmly rooted in industrial processes and infrastructure.

This document will help you understand that world

Past Editions