We have spoken with subscribers and reassessed the Real Asset Chartbook; many people have commented that it is a fire hose of information, rather than a succinct delivery of a few key points in the world of liquid real assets. As such, we will pivot slightly to see if the product, delivered differently, is more appealing. The PDF Chart Book, which contains all the information we use at Massif Capital on a day-to-day basis, is still available at the bottom.

This Week's Key Take Aways

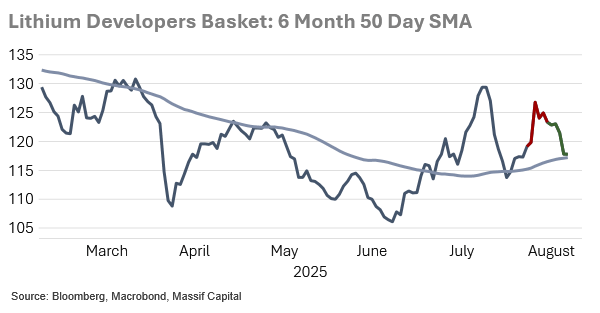

Lithium stock run may already be out of steam

Like Oil, the Natural Gas markets appear well supplied and are showing near-term weakness.

No love for North American lumber

Copper continues to have us on edge, love the long-term story, but we have got to survive the short and medium term to get there.

Renewable tax credit qualification has a new physical work standard; the race is on to build.

Fun Well It Lasted, Back to the Slog

Lithium carbonate prices jumped sharply in August after reports that Chinese lepidolite operations and CATL-linked output were suspended due to mining license issues. CME-linked benchmarks are up roughly a quarter month-to-date, and China spot prices have lifted above 80,000 CNY/t. However, analysts expect the spike to fade as supply resumes in September–October. We continue to think a return to a healthy lithium market is a late 2026/2027 story. We estimate, based on reading only no on-ground discussions, that Chinese lepidolite operations have a cost basis of 70k-75k/t CNY with pricing necessary to sustain operations likely north of 80k CNY.

Rebalancing the Lithium market will depend on China's EV demand and Energy Storage. The idea of 90% EV penetration in China by 2030 is a legitimate forecast, 50% of cars sold in China are now EVs according to BNEF. According to Canaccord Genuity, 200 gigawatt-hours (GWh) of energy storage contracts have been awarded this year. For context, according to Wood Mackenzie’s Q2 2024 outlook, global cumulative battery energy storage reached about 358 GWh by the end of 2024,

Our Lithium Developers Index jumped on the news last week, but sensing the limited reprieve, markets sold this week.

Why equity investors should care: A temporary price spike near or above Chinese lepidolite cash costs (~70k–75k CNY/t) tests marginal supply discipline and offers a brief window for developers and brine/spodumene producers with stronger cost positions to term-out prices, hedge, or raise capital before a likely retrace as suspended output resumes.

Relevant tickers: ALB, SQM, LTHM, PLL, SGML, TSLA, CATL, LAR, LAC, the list goes on.

Relevent Chartbook Pages: 13, 52

Gas Glut Gravity: Storage Swells, Prices Soften in the Near Term

Natural gas markets leaned bearish as production climbed and late-August weather turned cooler, lifting injections and pointing to near-record storage by end-October; prompt gas eased around the $2.9 handle while Asia LNG benchmarks slid roughly a quarter over two months, pressuring U.S. pricing and flattening the curve beyond 2026.

Despite sharp declines in prompt months, the 2026–2030 gas strip has held most of its gains since mid-June (near $3.75 vs. $3.86/MMBtu in mid-June), reflecting structural demand (LNG, data centers) even as summer burn fades and storage levels approach ample reserves.

Why equity investors should care:

NatGas: Lower gas pricing squeezes E&Ps with weak hedges but supports gas-burn-heavy power and industrials.

LNG: Marginal cargo economics affect utilization and cash flow pacing for LNG chains; watch maintenance windows and contract take-or-pay dynamics. Strip stability supports hedging and long-cycle project economics for midstream and LNG developers despite spot weakness

Relevant tickers:

Nat Gas Tickers: CTRA, EQT, AR, CHK, LNG, SHEL, RDS.A, KMI, WM,

LNG Tickers: LNG, TELL, NEXT, KMI, WMB, TRGP, ENB

Relevent Chartbook Pages: 62, 70, 71

Lumber: No Margin to Spare

On Aug. 8, 2025, the Department of Commerce announced it is more than doubling its countervailing duties rate on Canadian softwood lumber imports from 6.74% to 14.63%. Coupled with the anti-dumping rate of 20.6%, tariffs on Canadian lumber will now reach 35.2% (up from the current 14.4%).

The Tariffs won't help the industry, which has made no progress (in terms of equity appreciation) since 2020. With trailing 12-month profit margins closing in on their third straight negative year. We imagine that tariffs are passed on to consumers; our basket of lumber firms has negative margins all the way up to the gross margin level for two straight years, and they cannot absorb the tariff costs. Despite the weakening performance, balance sheets appear decent. Nonetheless, downside risk appears substantial, especially when comparing company fundamentals to those of the pre-COVID era.

Why equity investors should care: Higher tariffs tighten supply and theoretical support pricing for U.S.-focused producers while raising input costs for builders and building-products manufacturers. Pureplay US options seem limited, everyone has some exposure to the forests north of the border.

Relevant tickers: LPX, SJ CN, PCH, WFG CN, UFPI, WY, CFP CN, BCC, WEF CN, IFP CN

Its Never Easy - Resolution Copper Hits New Legal Roadblock Despite Political Backing

Pres. Donald Trump met with the CEOs of Rio Tinto and BHP and Interior Secretary Doug Burgum on Aug. 19, 2025.

The Ninth Circuit issued a temporary injunction halting a federal land swap for the Rio Tinto–BHP Resolution Copper project in Arizona, even as White House support was reiterated in meetings with the miners; the land exchange delay could push timelines at a project touted to supply up to a quarter of U.S. copper demand.

Meanwhile, the fiasco that is Copper Tariffs have left the US with an epic glut that has barely begun to unwind.

Year-to-date, our copper producers index is up 11.8%. Industry profit margins, as measured by our index of producers, have improved QoQ for at least 6 quarters, but the pace of improvement has slowed. A similar trend can be seen in Net Debt to EBITDA, which has also improved for 6 quarters, but has stalled (this variable should not be interpreted the same way as stalling margin improvement, but is telling of the capital allocation options management has).

Why equity investors should care: U.S. copper supply onshoring remains hostage to permitting and litigation risk, sustaining the premium for established producers and diversified global supply chains

Relevant tickers: RIO, BHP, FCX, SCCO, HBM, IE, The List Goes On

Relevent Chartbook Pages: 8, 9, 53, 58, 64, 66, 67

IRS Slams the Brakes on 5% Safe Harbor: Race-to-Groundbreak Will Reshape Clean Energy Winners

On August 18th, the IRS issued Notice 2025-42, which eliminates the Five Percent Safe Harbor for most new wind and solar projects after September 2, 2025, forcing developers to qualify tax credits via “significant physical work” begun before July 5, 2026 (with a narrow carve-out preserving the 5% safe harbor for solar projects ≤1.5 MW). This compresses timelines and shifts the gating item for tax credits from capital outlay to execution proof, privileging on-site construction (e.g., foundations, racking, substations) and off-site project-specific manufacturing under binding contracts, while excluding design/permitting/site prep. The practical outcome is a 2H25–1H26 scramble for EPC slots, skilled labor, and custom components, with well-capitalized developers and integrated utilities best positioned to lock eligibility and preserve project IRRs.

Expect pipeline triage and consolidation as smaller developers struggle to accelerate, while order mix pivots toward work and equipment that “counts” for begun-construction. OEMs and suppliers with custom, project-specific offerings (foundations, substations, transformers) may see near-term backlog pull-forward, but standard catalog components could lag. Post-deadline, projects that miss eligibility face impaired economics and potential cancellations, tempering 2027–2028 revenue visibility until FEOC supply-chain rules and sourcing pathways are clearer. Community/C&I solar ≤1.5 MW stands out as a relative winner given safe-harbor continuity, while utility-scale wind/solar faces a capacity-constrained sprint followed by a possible air pocket.

Why equity investors should care: This rule change immediately re-prices execution capability, advantaging balance-sheet strength, EPC access, and documentation rigor while raising cancellation/M&A optionality across late-stage pipelines. It also reshapes order books and margins over the next 12–24 months, creating alpha from identifying who can convert pipeline to “physical work” before July 2026—and who cannot.

Relevant tickers:

Developers/IPPs/Utilities: NEE, NRG, BEP, BEPC, AY, DUK, SO, XEL, EIX, PCG

EPC: PWR, MTHN, DY, PRIM, MTZ

Solar trackers/racking/foundations: ARRY, SHLS, NXT

Relevent Chartbook Pages: 13, 52

Download the Real Asset Chartbook

Until next week,