(New Weekly E-Mail Structure - Link To Weekly Chartbook at the Bottom)

Digging Deeper into the Charts

Our commentary this week is more limited and slightly disjointed, as we are not seeing any clear narratives or themes to focus on.

Here are a few charts that caught our attention in flipping this week’s chartbook.

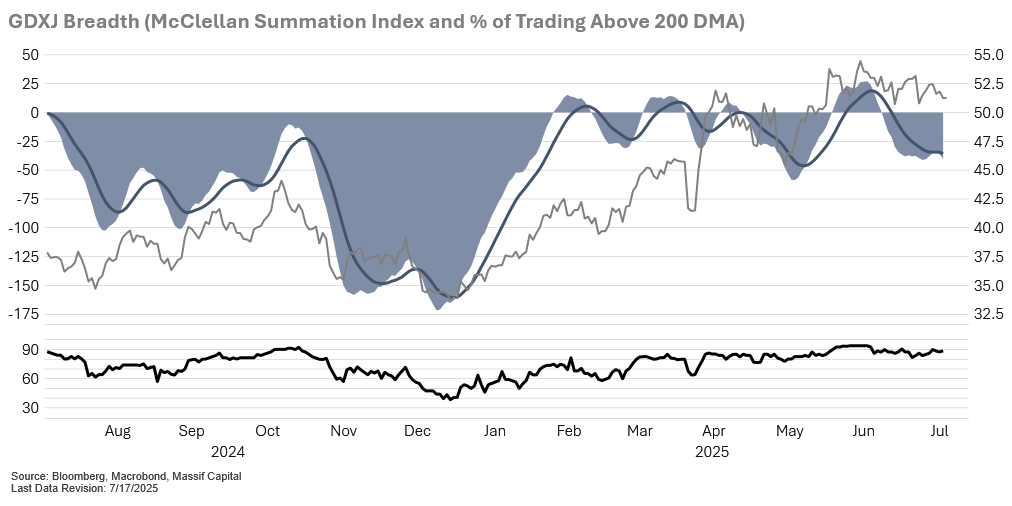

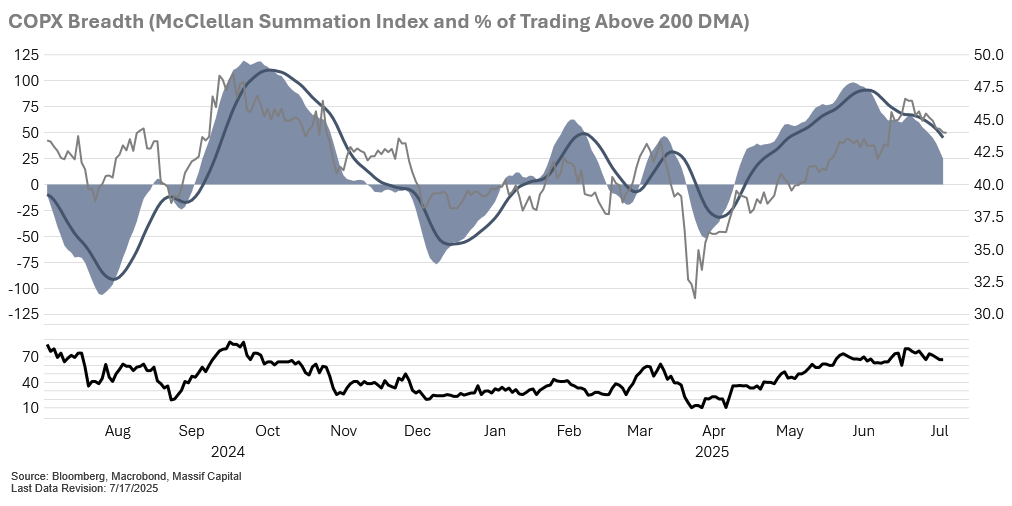

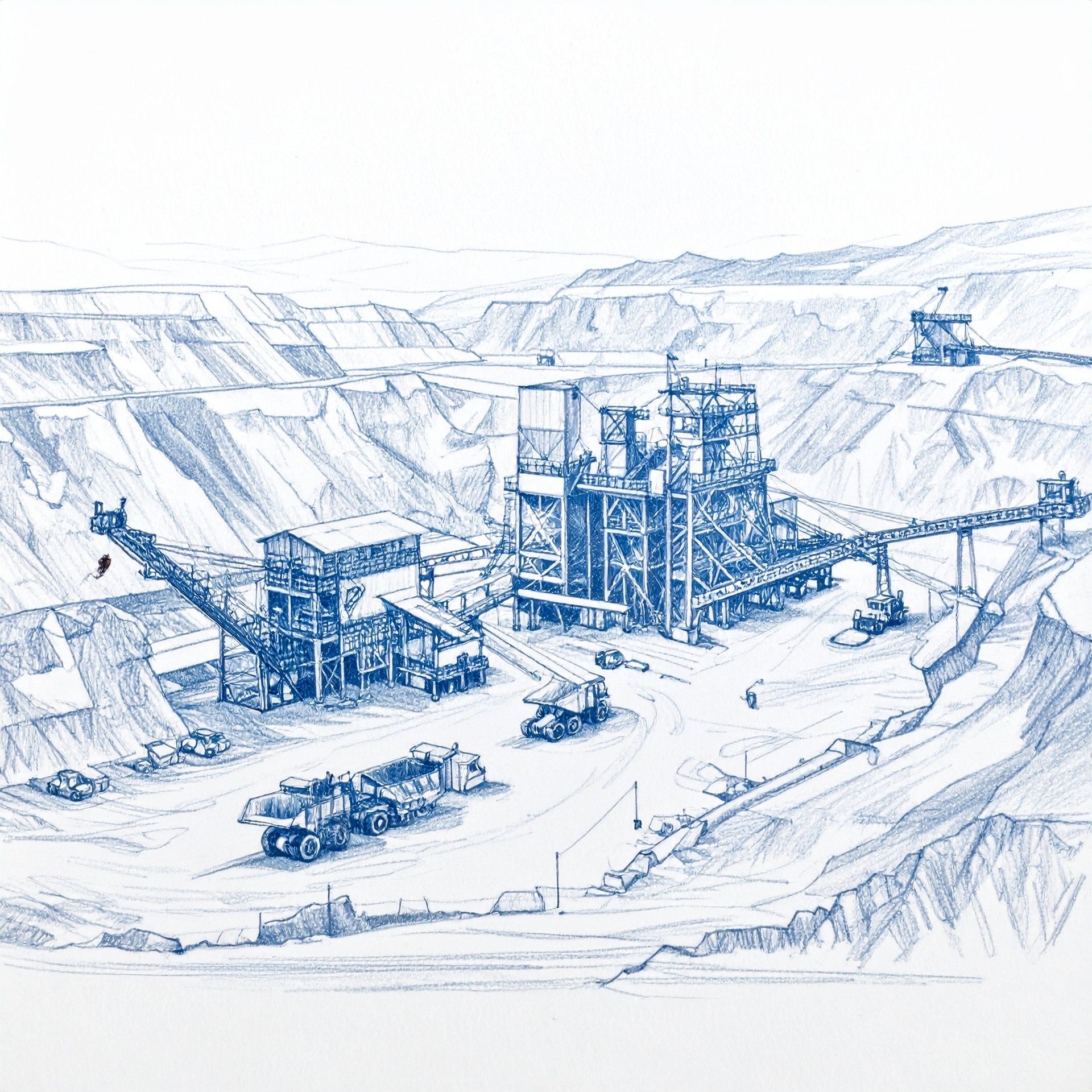

Our tactical breadth charts, specifically for metals and mining stocks, suggest that a reversal of the recent rise may be in the cards. The underlying breadth of the stocks in ETFs such as COPX (copper miners), GDX (gold miners, PICK (general mining), is robust, with greater than 70% of underlying stocks trading above their 200-day moving averages. While medium-term consolidation at such points is possible (see the GDX), we are skeptical of the stability of such bullish behavior. See Breadth Charts on Pages 47-50.

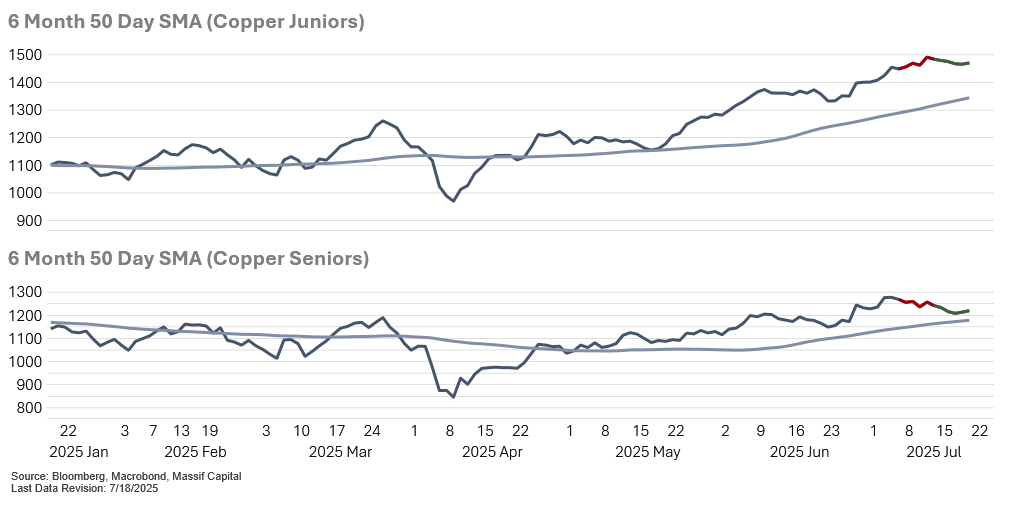

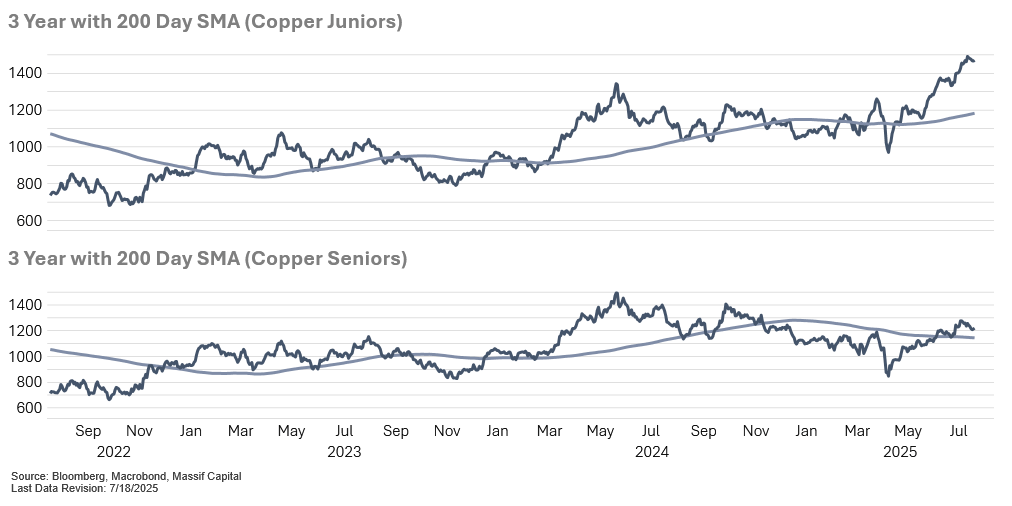

Copper Equities, in particular, seem set for a pullback in our opinion. The stocks have all had a run and a period of consolidation as the world digests both tariffs and a new price paradigm, along with wildly unbalanced inventories, seems appropriate. That downward move appears to have started last week/this week, depending on what you are looking at:

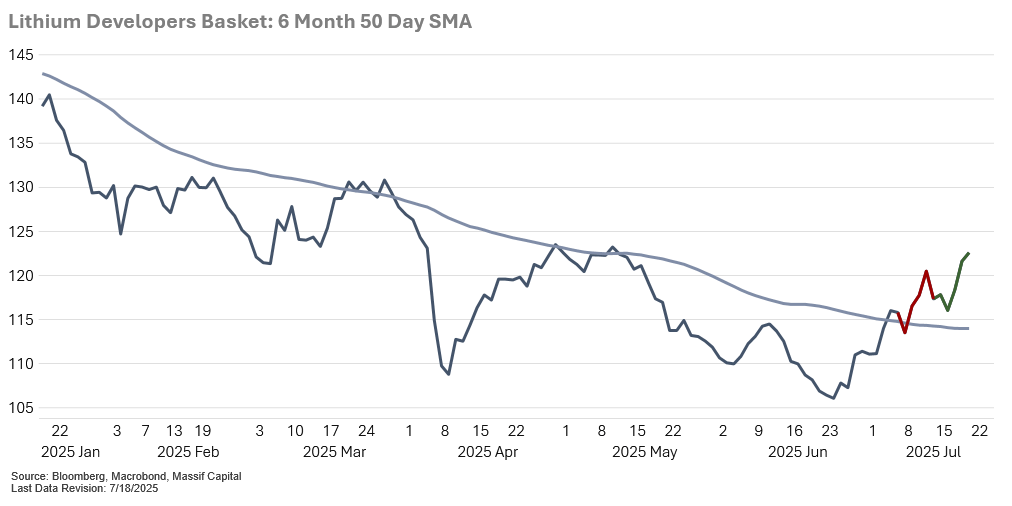

Not all commodities, and thus not all commodity producers, have participated in the recent run of good performance. Lithium stocks have been clear losers this year, but we think that might be changing. This week will mark the fourth consecutive up week for the group, and we believe there may be more positive movement ahead. The underlying fundamentals of the industry remain challenging, with a well-to-oversupplied market this year and likely next, but the industry was about as bombed out as it gets.

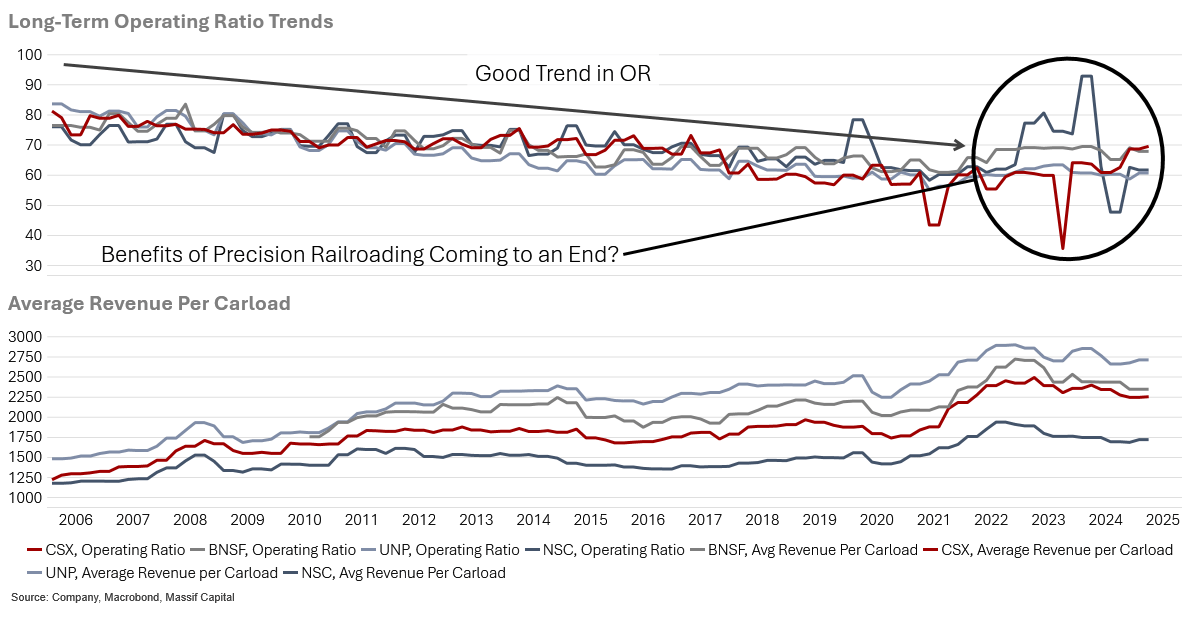

To close it out, a few thoughts on today’s big merger rumors in the railroad space. Based on a Bloomberg reporting, it sounds like a merger between Norfolk Southern and UNP could be in the cards. If it were to happen, it would create the largest Class I railroad by originating volume, according to AAR data; yet, it's tough to see how such a transaction would not face significant legal and regulatory hurdles. Such a tie-up would likely compel CSX and BNSF to pursue a merger, lest they be at a competitive disadvantage relative to a UP-NS network. At a measly $64 billion in market cap, Warren and crew could easily swallow CSX with plenty of cash to spare. One wonders if Warren has a last hurrah in him, or could it be Greg Abel’s first big move?

Our understanding is that a transcontinental railroad operation could squeeze some extra margin out of the system by eliminating redundant infrastructure, optimizing routing, and lowering interchange costs by avoiding the need for freight to change hands at major rail hubs. As the chart below shows, mergers might be the economic balm to fix what seems to be an ailing industry. The success of precision railroading appears to have run its course, with the positive trend in both operating ratios and average revenue per carload seemingly coming to an end of a nearly two-decade trend.

Essential Real Asset Reading

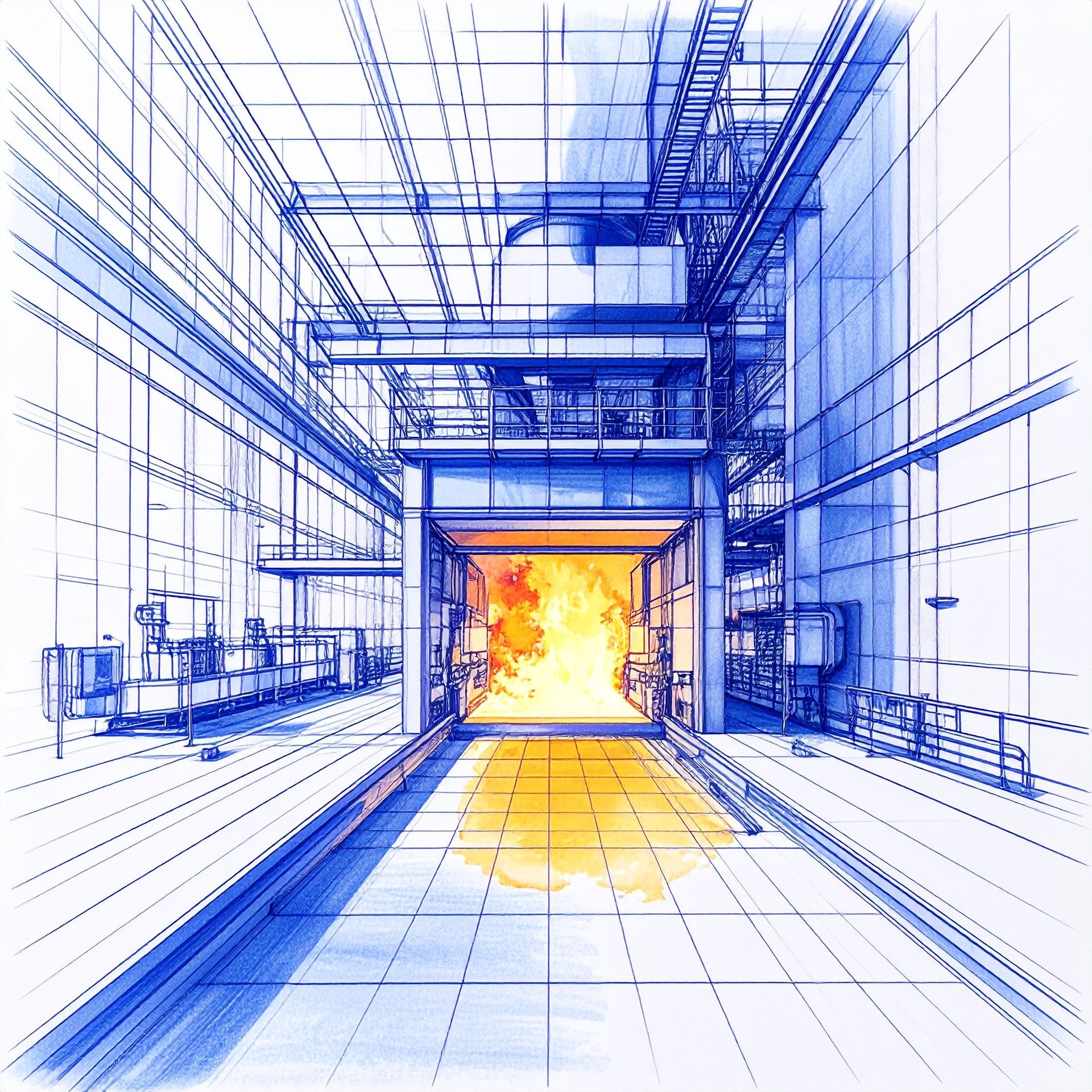

Plenty of Copper, No Smelters

As noted in the Foriegn Affairs essay linked below about Critical Mineral Policies, refining is perhaps in even more desperate need of policy support then mining. As Bloomberg highlights the US has large copper reserves but few smelters to process the ore. Efforts to revive the industry face challenges like long project timelines and expensive infrastructure needs.

War on Russian Gas

Last night the EU approved fresh sanctions on Russian oil. The EU is not stopping there, they are also planning to ban all imports of Russian Gas by 2027.

Trade Policy Leverage, Real or Imagined

Americans have always had a strong desire for trade with other nations, as noted by early leaders like John Adams and Thomas Jefferson. Attempts to use trade as a weapon, like Jefferson's embargo on Britain, often backfired and led to unrest. Ultimately, it seems Americans prefer military action over trade disputes.

Policy Proposals for Critical Minerals

The United States relies too much on China for critical minerals needed for defense and technology. To fix this, the U.S. must boost mining, refining, recycling, and develop new technologies at home. Strong government support and funding are needed to secure supply chains and protect national security.

From Colonial Grievances to Modern Industrial Strategy

The First Essay In This Series: Missives on The History of US Trade

Last week, we outlined a framework from Douglas Irwin’s “Clashing Over Commerce: A History of US Trade Policy” for understanding US Trade Policy. That framework suggested American trade policy has consistently pursued three primary objectives throughout its history: Revenue, Restriction, and Reciprocity. This week, we examine the era from before the Revolution to the Civil War and utilize that framework to unpack the trade policy debates of the past to see what lessons we can learn about today's political wrangling.

America's trade policy debates have followed a remarkably consistent pattern from colonial times through the present day, driven less by abstract economic theory than by shifting coalitions of regional interests, security concerns, and the eternal struggle between protection and openness. These foundational tensions continue to shape contemporary discussions about rare earth minerals, steel industry consolidation, and the broader question of economic nationalism in an interconnected world.

The Colonial Foundation: Commerce as Power

The American experience with trade regulation began not with independence, but with rebellion against Britain's Navigation Acts, which required tobacco to be shipped through London ports and inflated the cost of Asian imports. These mercantilist constraints taught colonists that trade rules were instruments of political control rather than neutral economic arrangements. When Britain tightened enforcement after 1763 to pay for the Seven Years' War, the colonies had their first lesson in commercial coercion, a lesson they responded to by boycotting British goods. The political impact of these boycotts far exceeded their economic effect, creating the dangerous illusion that America possessed significant commercial leverage over its major trading partners.

This early experience with commercial coercion would prove prophetic. Jefferson's embargo of 1807-1809 demonstrated the limits of using trade as a weapon, shrinking American GDP by approximately five percent while failing to force Britain or France to respect neutral shipping rights. The embargo's failure foreshadowed the mixed record of modern economic sanctions, where domestic adjustment costs often exceed the foreign policy benefits achieved. Contemporary chip export controls on China and debates over critical mineral export restrictions echo Jefferson's hope that our markets represented economic leverage. Still, effectiveness hinges on the same factors that undermined the embargo: allied coordination, domestic political sustainability, and the target nation's ability to find alternative suppliers.

This essay was meant to be short, but it got long. The remainder can be found here: From Colonial Grievances to Modern Industrial Strategy→

Until next week,