In late 2018 we published a piece examining potential changes in the hundred-year-old business model of electric utilities. We argued that while new energy technologies posed challenges to the legacy business, the long-term outlook for the industry was strong given trends in electrification. We also highlighted a growing divergence between utilities in how they choose to allocate capital, which we thought provided a window into how management teams were evaluating the present risks and future opportunities. We continue to be optimistic about the long-term potential of utilities to reinvent themselves, but the road to get there may be painful.

Headwinds have intensified for utilities and our research requires a refresh, we have identified four key drivers we believe essential for understanding the future of the existing utility business model. A review of the original paper may be helpful for those that need a refresher on U.S. electricity markets and the utility business model.

Increases in variable and distributed energy resources create growing tensions with the legacy utility model.

Utility customers are no longer just ‘endpoints’ on the grid. The growing adoption of residential solar, especially in places like California, means that customers are becoming active grid participants. This is a difficult operational challenge for utilities and is becoming increasingly costly to manage.

A good example of this challenge is a program called ‘net metering’. Some utilities will allow customers the option to sell electricity back to the grid. It is often a critical selling point for residential solar providers who need to make an economic argument that their product is cheaper than residential retail rates. Residential solar is far more expensive then utility scale solar, and net metering often shifts some of that cost from the individual consumer on to the utility, who often pass it back to consumers who can’t afford their own residential solar setups in the form of higher electricity costs. In doing so, net metering is socializing a private cost at the expense of those least able to afford it.

In theory, we are supportive of the idea of net metering. It’s one of many programs that are attempting to economically incentive the increase of renewable energy resources, and we are broadly supportive of such efforts. It’s problematic however if the solutions are not sustainable.

This tension between increasing renewable energy resources and the associated costs or increased fragility of the system that the utility is responsible for bearing, is likely not subsiding. More broadly, utilities are not incentived to change. The monopoly like status of vertically integrated utilities limits the competitive pressure to pursue any type of reform. Increasing distributed resource generation affects the utilities sales volumes to customers which in turn puts pressure on the rate design and recovery for future capital investment. Additionally, as restructured utilities cannot use generation costs as a pass through, they are limited to earnings opportunities within distribution and transmission infrastructure. They are, in short, not incentived to consider non-utility owned solutions and non-wire alternatives.[1]

Lastly, any alternative investment will likely need to be cost-effective relative to the incumbent. If every solution presented to the utility is increasingly cheaper, and the utilities revenue is directly tied to the cost recovery of ‘cheaper’ solutions, revenue falls. Shareholders of utilities might grow increasingly concerned that valuations may shrink if ‘cost-effective’ alternative investments are pursued. [2]

Utilities have grown Electric supply for a decade, but demand has remained stagnant. It’s not clear how that trend can continue.

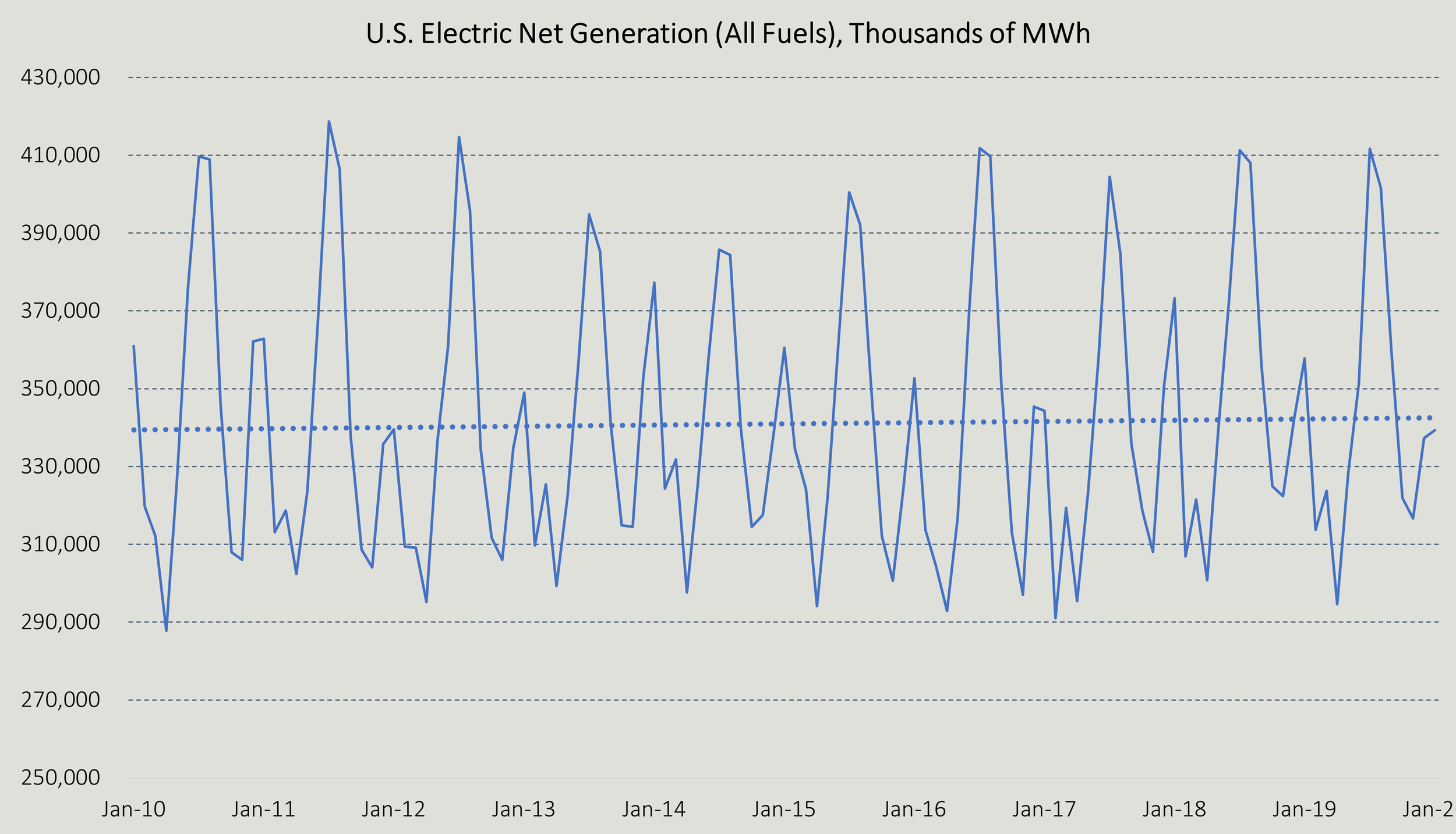

Electricity consumption has been flat since 2010 as can be seen in the graph below.[3] On a per capita basis, U.S. consumption has fallen by about 6% over the last 20 years.

Despite stagnate demand, electricity supply has grown by 7%, net of retirements, over the last 10 years. Power industry construction grew 13% over the last decade, and utilities saw their capital expenditures as a percent of sales grow by 21% over the last seven years. The growth in CAPEX spending combined with falling demand is a trend that cannot continue without threatening significant write downs in asset values. This is particularly true of the combined cycle turbine facilities that have been built over the last ten years with the expectation of low natural gas prices going forward but have lives that will almost certainly take their operations into a period when gas prices are not nearly so favorable.

The physical risks of climate change are not being priced correctly.

Most of the 8,625 power plants in the US have been purposefully sited near shorelines to have access to water. As climate change risks accelerate resiliency to extreme weather events will become increasingly important. Hurricane Katrina in 2005 forced Entergy New Orleans into Chapter 11. McKinsey recently found that utilities in the seven states on the east coast of the US most prone with hurricanes may see $1.4 billion in storm damage costs and lost revenues due to outages caused by storms over the next two decades. A recent Blackrock report argued that climate-related risks to utilities are a) real and b) not priced in at this point. The report contends that ~38% of the gas and nuclear generation capacity in the US is exposed to extreme climate risks. That’s more than 50% of total U.S. generation.

Electricity markets are becoming politicized. Utilities will have to adapt.

Legal and regulatory challenges to the existing utility business model are becoming more common and more pressing. At the same time the role of political appointees with non-economic incentives are playing an increasingly large role in regulatory bodies.

In December, FERC ruled that the regional transmission authority in the Northeast must institute a ‘minimum offer price’ for any capacity that bids into their market auctions that have received subsidies, thus ending the historical indifference of such markets to fuel source. Last month, the New England Ratepayers Association filed a petition with the FERC, asking it to declare "exclusive federal jurisdiction over wholesale energy sales from generation sources located on the customer side of the retail meter.” In other words, NERA is asking FERC to assert control over all state net-metering programs. Ari Peskoe, director of the Electricity Law Initiative at Harvard recently commented that the petition “seeks to end net metering as we know it”. This has significant implications whether residential solar is in fact economic relative to residential retail rates.

Heavy handed regulation and political involvement in the utility industry is creating a conflicted operating environment and preventing the industry from evolving naturally in face of changing market pressures. Should this continue, the utility industry will become increasingly fragile.

We think the following questions are important for utility management teams to consider and, essential questions for investors to ask management teams when considering an investment:

How do you address the challenge to the grid (a public good) posed by distributed energy (a private good)?

How are you looking to manage the non-negligible physical risk your utility assets are faced with while their importance to society is increasing? If you cannot, how are you preparing to address the associated liability and fallout from potential physical risk events (think PG&E and California wildfires)?

How will you manage potential asset write downs and stranded asset risk of newly built generating assets that are dependent on a volatile fuel source while zero-marginal cost generating assets are added to the grid?

If political appointees are increasingly becoming the arbiters of electricity markets, how do you as a utility management assesses the stability of traditional revenue streams?

[1] Energy efficiency would be considered a non-wire alternative.

[2] Again, it’s worth repeating that we are in favor of electricity grids dispatching at the lowest possible cost subject to the grid’s physical constraints. That said, we must be cognizant that current shareholders of these utilities may not be in favor of their business shrinking should the total costs to service the grid fall. In addition to decarbonization goals, the deployment of renewables, or any new technology, is likely going to be cost effective relative to status quo. Unless total demand is increasing faster than the cost to provide service, a consequence of renewable energy is that the systems ability to recover costs (revenue) falls. Shrinking business are generally not looked upon favorably by shareholders.

[3] We are using net generation as a proxy for consumption. In the absence of stored electricity or waste heat, generation will always equal consumption.